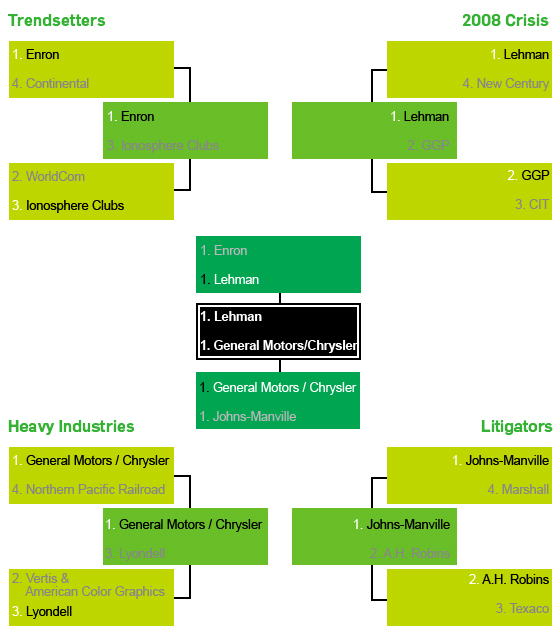

And then there were two . . . the results of the Weil Final Four Bankruptcy Brackets are in. Lehman, the undisputed favorite in the tournament, overcame Enron’s valiant effort to reach the finals. On the other side of the bracket, General Motors/Chrysler drove past Johns Manville to create a very interesting match-up for the top bankruptcy case of all time.

In many ways, the bankruptcies of Lehman and General Motors/Chrysler are more interconnected than what you might expect. Lehman’s bankruptcy was the primary catalyst for the debilitating crush to the commercial and consumer credit markets that rendered it impossible for General Motors/Chrysler to continue. Each of the cases have been at the heart of the “too big to fail” debate as their failures were capable of causing systemic consequences to ripple across the financial markets and broader economy. In both cases, policy makers considered whether the assistance of the federal government and the utilization of tax-payer dollars was warranted to cushion the fallout upon the failures of these entities. The difference is that in Lehman, no such governmental assistance was forthcoming while in General Motors/Chrysler, such assistance was provided.

According to Harvey Miller, who represented both Lehman and General Motors in their chapter 11 cases, “Lehman was the consequence of a decision by the government that moral hazard had to be respected, and irrespective of potential consequences, no assistance could be extended to Lehman in any form whatsoever, including support for an orderly wind down.” The result was an unplanned chapter 11 filing and the immediate destruction in value and the triggering of defaults and guarantees around the world. Credit markets essentially closed, equity indexes plunged, and the derivatives markets were rocked by uncertainty.

Perhaps cognizant of the systemic consequences that ensued after Lehman’s bankruptcy, the United States and Canadian governments were very involved in the bankruptcies of General Motors/Chrysler. The governments provided DIP financing and also sponsored the entities which purchased the assets of General Motors/Chrysler under section 363 of the Bankruptcy Code. The governmental assistance played a critical role in preventing the failures of a myriad of plants, suppliers, and dealerships. Harvey Miller notes that the “potential chain reaction that could have caused the abrupt and complete demise of the automotive industry and the loss of hundreds and thousands of jobs crystallized the thinking of the government.”

Whether the top case of all time should be Lehman, a case where governmental assistance was not provided, or General Motors/Chrysler, cases that involved significant governmental involvement and assistance, is now up to the readers of the Weil Bankruptcy Blog. Voting ends tomorrow at 11:00 a.m.

Click here to take survey

Printed from

Weil Restructuring Blog

|

|

|

Titanic Two Championship Bankruptcy Bracket

Copyright © 2025 Weil, Gotshal & Manges LLP, All Rights Reserved. The contents of this website may contain attorney advertising under the laws of various states. Prior results do not guarantee a similar outcome. Weil, Gotshal & Manges LLP is headquartered in New York and has office locations in Boston, Brussels, Dallas, Frankfurt, Hong Kong, Houston, London, Los Angeles, Miami, Munich, New York, Paris, San Francisco, Silicon Valley and Washington, D.C.

|