European corporate distress is deepening amidst persistent challenges in profitability and lack of investment, as highlighted by the latest Weil European Distress Index, which analyses data from more than 3,750 listed corporates and financial market indicators.

The latest Distress Index signals a shift in pressure over the past quarter, with falling profitability becoming the main driver of corporate distress. This marks a critical period for European companies amidst economic fluctuations and market uncertainty. Businesses are grappling with the dual challenge of managing rising costs and sustaining production, exacerbated by the ongoing battle against inflation and high interest rates. Having passed through cost increases, companies are now having to reduce prices to sustain sales volumes. Rising input costs will squeeze margins further and put more pressure on corporates’ profitability.

Market trends

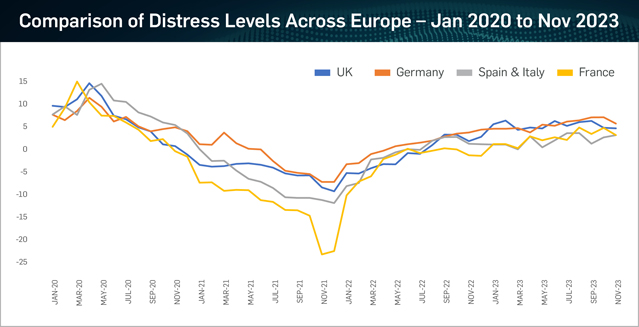

Germany emerges as the most distressed market in Europe, influenced by several factors such as deteriorating investment metrics, liquidity pressures and stagnant profitability, which have persisted since the beginning of the year. The country’s economic outlook remains bleak, with both its government and the European Commission projecting a 0.4% contraction in its economy for 2024 due to high inflation, elevated energy prices and sluggish international trade.

Whilst there has been a slight easing of corporate distress in the UK compared to the previous quarter, it remains significantly higher than the same period during the previous year. The underlying factors driving this distress – weaker investment metrics, tightened liquidity and reduced profitability – persist. The ongoing impact of higher interest rates is affecting corporate borrowing, with many businesses struggling to adapt to increased debt servicing costs whilst contending with burdensome refinancing. Due to legacy issues, the UK is also grappling with difficulties of financing large infrastructure projects.

Elsewhere in France, traditionally the least distressed market in the Index, there has been a notable shift, now ranking third place in the latest quarter. France’s economy is experiencing similar challenges to the UK, with deteriorating investment metrics and growing pressures on liquidity and profitability. Exacerbating this is a declining GDP (down 0.1% compared with a 0.6% rise in the previous quarter), restrained consumer confidence, inflation surpassing targets and a contracting manufacturing sector – all signalling wider issues in the labour market and a worsening outlook.

Meanwhile, Spain and Italy, though still the least distressed regions, are experiencing distress levels above the long-run average, influenced by falling profitability and weaker investment.

Figure 1: Comparison of corporate distress by markets

Corporate distress can be defined as uncertainty about the fundamental value of financial assets, volatility and increases in perceived risk. It also refers to the disruption of the normal functioning of companies’ financial performance. There are several common characteristics of corporate distress: liquidity pressures, reduced profitability, rising insolvency risk, falling valuations and reduced return on investment.

Sector trends

High interest rates, falling valuations, elevated energy and construction costs and increasingly expensive financing are all bearing down on the European Real Estate Market, keeping it the most distressed sector according to the Distress Index. In the residential market, rising interest rates are also impacting housing affordability, softening the outlook for house prices. These ongoing struggles reflect broader economic challenges.

Whilst there was a slight moderation in distress during the latest quarter, the Healthcare sector remains the second most distressed. Persistent elevated distress levels result from the compounded impact of higher interest rates and increasing debt servicing costs. This financial strain is particularly acute for highly leveraged businesses – many of which are burdened by leveraged loans. Liquidity issues, worsened by poor investment performance and rising operational expenses are further squeezing margins.

Retail and Consumer Goods companies continue to face heightened levels of distress. With the double squeeze of higher remortgage rates and escalating rents, discretionary spending power is being eroded. Despite signs of declining inflation, the cost of living in key European regions like the UK and Germany remains high, limiting consumer spending. Moreover, the escalation of tensions in the Red Sea has adversely affected global trade, impacting trade routes due to Houthi attacks on commercial shipping. This additional disruption to trade routes poses a significant challenge for European retailers, worsening concerns about profitability.

Contributor(s)