Judge Drain has now issued a long-awaited Order on Remand from the Second Circuit’s decision in Momentive Performance Materials determining the appropriate cramdown interest rate applicable to replacement notes issued by Momentive. The decision is a win for noteholders who fought (and voted) against their plan treatment in Momentive’s chapter 11 plan, which was ultimately confirmed (or crammed down) over their objections in August 2014. While cramdown is still available as a tool in chapter 11 following the Second Circuit’s decision and Judge Drain’s Order on Remand, its coercive effect is now likely more limited with respect to secured creditors given the “process efficient” market rate of interest that replacement notes are entitled to.

Key takeaways are:

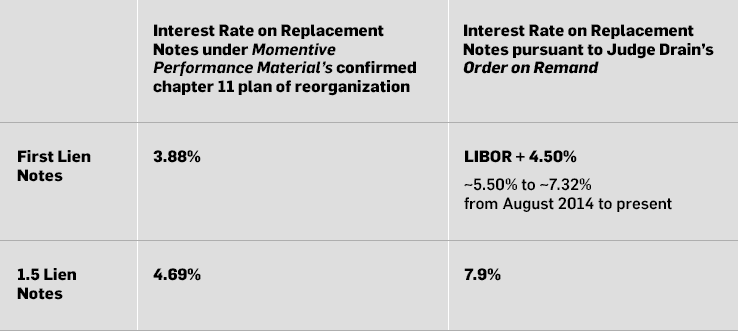

- Cramdown interest rates on Replacement Notes:

- Replacement First Lien Notes: The bankruptcy court established an interest rate of LIBOR + 4.50% for the Replacement First Lien Notes. Three-month LIBOR in August 2014 was 0.23%, 2.60% in April 2019 and reached a high of 2.82% in December 2018, implying an interest rate of between ~5.50% to ~7.32% for that period for the Replacement First Lien Notes. By way of comparison, the Replacement First Lien notes received a fixed 3.88% rate under Momentive’s chapter 11 plan. This cramdown rate is comprised of three-month LIBOR (with a 1% LIBOR floor) + 4.50%, inclusive of .50% of OID and .375% of market flex.

- Replacement 1.5 Lien Notes: The bankruptcy court established an interest rate of 7.9% for the Replacement 1.5 Lien Notes, materially higher than the Reorganized Debtors argued for, but lower than what the 1.5 Lien Notes Trustee was seeking. This is a 3.21% bump in rate for the Replacement 1.5 Lien Notes that received a fixed 4.69% rate under Momentive’s plan of reorganization.

- Bankruptcy court’s mandate on remand: Determine whether “traditional market efficiency” or “process efficiency” exists: Despite such a process not being required to cram down a secured class of claims under a chapter 11 plan, the bankruptcy court interpreted its mandate on remand from the Second Circuit as one in which it should determine either that traditional market efficiency existed at the time of confirmation of Momentive’s chapter 11 plan, or that efficiency in the form of a fair and transparent competitive process (what the court refers to as “process efficient”) existed at the time of confirmation. “Process efficient” terms are those reached between sophisticated parties that arrive at a potential exit loan with a term, size and collateral comparable to the proposed forced cram down loan.

- Efficient market for chapter 11 exit financing was not established…: Judge Drain was not able to conclude, based on the evidentiary record before him following the trial held in August and September 2018, that an efficient market for chapter 11 exit financing with a term, size and collateral comparable to the Replacement Notes existed at the time of confirmation of Momentive’s chapter 11 plan.

- …however, financing activity during chapter 11 cases provides “process efficient” proxy to determine interest rate on Replacement Notes: Judge Drain was able to conclude that “process efficient” financing did exist for Momentive at the time of the confirmation of its plan. This conclusion was based on (1) back-up exit financing having been negotiated by Momentive during its chapter 11 cases with a term, size and collateral comparable to the First Lien Replacement Notes; (2) Momentive having negotiated a proposed bridge facility commitment letter during its chapter 11 cases which, coupled with expert testimony, enabled the bankruptcy court to determine a process efficient market for exit financing of a term, size and collateral comparable to the Replacement 1.5 Lien Notes; (3) the timing of such back-up exit financing negotiations taking place shortly before confirmation of Momentive’s plan; and (4) the negotiation for the back-up financing taking place at arms-length by sophisticated parties in a competitive process that was relatively transparent and subject to court review.

- Entitlement to unpaid interest: The bankruptcy court confirmed that the Replacement Notes were entitled to receive unpaid interest calculated as the difference between the interest rate that the Replacement Notes were issued at, and the “process efficient” rate determined by the bankruptcy court.

- Memorandum of Decision to follow: The Order on Remand was issued following parties to the matter informing the court that it is materially important to them to promptly obtain the court’s ruling on remand. The Memorandum of Decision will follow and we will update you when it does.

Contributor(s)